Democrats Renew Hope for Renewables. And Healthcare. And Maybe More.

Neobanking: A Fresh Way of Banking

October 1, 2022

VoB Bulletin 3rd Issue

November 5, 2022Democrats Renew Hope for Renewables. And Healthcare. And Maybe More.

Do you remember the last time seeing a winning headline for environmental or renewable energy issues? Except those lockdown nature-healing news? The picture’s often been dreary.

But, this time, the hope is there again somehow, as Democrats passed the historic climate bill- IRA (Inflation Reduction Act) with a $375B investment in renewables, the largest clean energy allocation in US history.

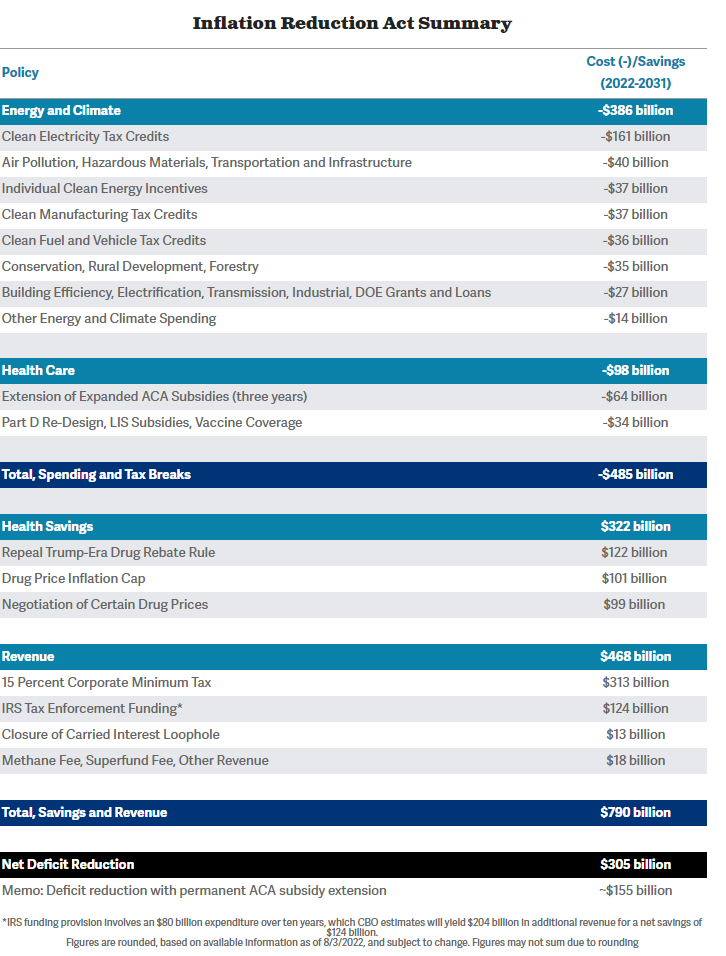

On August 12, 2022, the total $750B bill saw the face of victory with 50 Democrat votes and a tiebreaker from Vice President Kamala Harris and no republicans voted for it, unanimously. And IRA is also a health and tax bill at the same time. It aims to reduce prescription drug costs, lower the country’s deficit and reform the tax structure.

Ok, first things first. Climatologists are hopeful about this $375B investment, there’ll be more financial backing to fight this global challenge. Not only that, the bill aims to lessen 40% CO2 emission by this decade, bringing it down to below 2005 level! Americans, planning on buying electric cars, can save extra as this bill will offer $7500 tax credits on certain, new EVs and $4000 on used ones. Tax breaks on solar panels will also encourage people to work towards a shared, environmental goal.

Well, how’s this a ‘health’ bill? For the first time, Medicare (US government national health insurance program) gets the chance to negotiate certain drug prices. It also received a $2000 cap on out-of-pocket prescription drug costs. Citizens now have to spend less on healthcare insurance and the government can invest more on medicines. Remember the much-known Affordable Care Act aka Obamacare? IRA also extends subsidy for this act.

And, lastly, it’s also a tax bill. Biggest corps and richest Americans will now pay more for taxes (well, according to this act) and so will corporate buybacks. There’s also something for companies making at least a billion in a year- a 15% tax which will contribute to reducing the federal deficit by $300B. Will this additional tax bring layoffs or worsen the unemployment problem? Will this make the wealth distribution a bit more even? That can be another discussion.

This 730 page IRA bill is actually a squeezed form of the $3.5 trillion budget plan proposed by Biden.

So, what are others thoughts on the IRA? Republicans, for one, think that it’ll worsen the inflation situation. According to the nonpartisan Congressional Budget Office, this bill puts a "negligible" effect on inflation in 2022 and into 2023. If that’s the case, the name “Inflation Reduction” will be questioned. But even if the IRA hits clean energy, healthcare and economic goals, won’t it have gone a long way?

Outwardly it seems not but the IRA has its effects on countries like Bangladesh too. Specially, possible policy implementation and economic changes stemming from such a major power are likely to influence other countries in this globalized world.

Author -

Amrina Rahman, Senior Writer|Editorial, Voice of Business

Visual Designer -

Md. Sakib Nahid, Executive|Publication, Voice of Business