A Critical Review of Declining Interest Rate in Bangladesh

IT’S NOT WHAT IT LOOKS LIKE

October 6, 2019

Spare Yourself a Cold To Spare Yourself from Coronavirus

January 27, 2020A Critical Review of Declining Interest Rate in Bangladesh

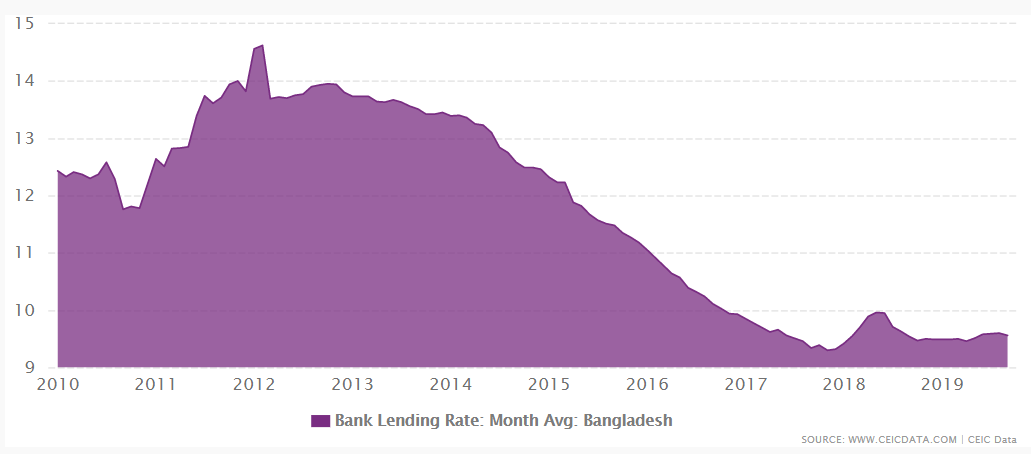

Bangladesh Bank has recently decided that commercial banks should have a weighted average interest rate, not more than 9.6%. But the top management of the banks are not appreciating the step. Now, for any further assertion on this, the reasons behind this declination should be thoroughly discussed. Even before digging deep into the reasons, a piece of information will be of great use. That is, the declination in lending interest rates is not a new phenomenon. There has been a declining trend since 2012 and it has reached its lowest record in recent times.

What are the problems arising out of this declining trend? Firstly, the deposit interest rate has also declined 43% in the last 5 years since banks have to maintain a considerable spread. Secondly, the interest rate on savings paper is increasing which has made bank deposits a less lucrative option. Moreover, the opening of 3 new banks with a prior opening of 9 more new banks has increased the number of banks and has made the market more competitive. An economy as the size of ours is not expected to have a lot of savings. So, a lot of banks are going through liquidity crisis. On top of that, the decrease in deposit interest rate has made the bank deposit a less viable option.

Considering all these, is it logical to decrease the lending interest rate? Now consider the fact that bank borrowing has declined 34% in the first quarter of 2019 and private sector credit growth has dropped down to a nine-years-low of 10.66%. Now, this seems like a matter of concern for which interest rate should be lowered down. But these recent issues are not the key reasons that have affected this declination.

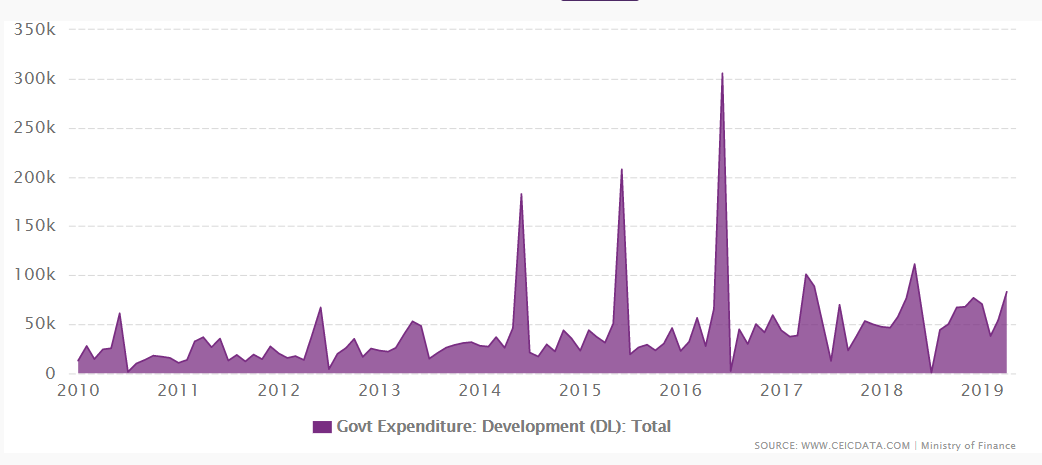

The development of infrastructure throughout the whole country and the construction of many mega projects which have never been done before are key issues in analyzing this. Payra Deep Sea Port, Dhaka Metro Rail, Padma Bridge, Ruppur Nuclear Power Plant – all such projects are happening at the same time. The development budget has increased as never before. As we see from the graph, in 2014, 2015 and 2016 the development budget rocketed up to over 200k USD, which has never been over 100k USD before.

Financing of these projects has been done with loans from internal and external sources which has increased government debt to a substantial level. Where internal debt of the government was nearly 500k USD in 2010, it has reached to 1400k USD in 2019. At the same time, the external debt has increased nearly 1.5 times in last 10 years.

Given the situation of government debt in recent times, the initiative to establish Specialized Economic Zones (SEZs) throughout the country and other planned development projects need even more funding which requires rapid repayment of the current debts. As the government set a target to bring in $7.2 billion foreign loans in the ongoing fiscal year, it was required to repay the current debts. So the debt repayment has reached an all-time high altitude in recent times and has hit $1.34 billion in first 10 months of 2019.

To finance the repayment of debts, the most feasible way to respond to it from the point of view of the government was to increase taxes. The increasing trend in tax revenue is a result of this. In the last 10 years, tax revenue has increased nearly 2.5 times. But the inevitable result of this increase in tax is a lower output in the economy. In this era of population bonus, lowering outcomes in the economy is not appreciable. As per the IS-LM Model of Macroeconomics, the only way to increase output is to increase investment by decreasing the interest rate of loans to be disbursed. But, seemingly, lowering the interest rate is not being so helpful due to the increase in the number of banks and an increase in the interest rate of savings papers. As a result, a significant number of banks have to disburse loans from capital investment rather than deposits. Moreover, fraud and the increasing number of NPLs have worsened the situation for the banks.

Now, what can be a way out from the perspective of the banks? The rule of thumbs should be to cut off operating expenses and to increase the efficiency of the management. The government should play an important role in the process. Increasing the allocation of the ongoing projects should be checked. Projects should be finished within the pre-allocated budgets. Finally, checking the performance of loans properly and decreasing the number of NPLs can be very helpful for commercial banks. Hopefully, in the future, we will have a healthy economy that grows at an expected rate.

Contributor:

Najib Hayder

Department of Banking and Insurance

Faculty of Business Studies

University of Dhaka